In the study of Palos Verdes real estate trends, as many of you know who’ve been following me on my blog posts, on my old website, or on these various social media platforms (Facebook, Instagram, LinkedIn, Twitter), when I comment on the Palos Verdes homes real estate market, I try hard to minimize opinion and concentrate on the facts. We all know what facts are; they are verifiable, credible, and reliable. Play the video below first, then dive in to the data below…

Did you get to the warning part about pricing your home correctly and the calculations on how much you will lose if you don’t? What you see below is the newest and latest video available. After you view the video, feel welcome to schedule a time with me so we can figure out how buyers might perceive your home in the context of current supply/demand forces or how you can best strategically position your offer on a home and win it. After you play the video, hit the like button and do subscribe to my channel for future updates.

While this article contains incredible information, I’m holding back my proprietary indicator, which I’ve developed over my 45+ years in the business. It has correctly predicted market corrections in the past and made/saved my clients millions of dollars. I work for a living, so to get access, contact me here, and we can discuss the conditions necessary for you to receive this indicator.

What are the “facts” when it comes to analyzing real estate markets, specifically Palos Verdes real estate trends?

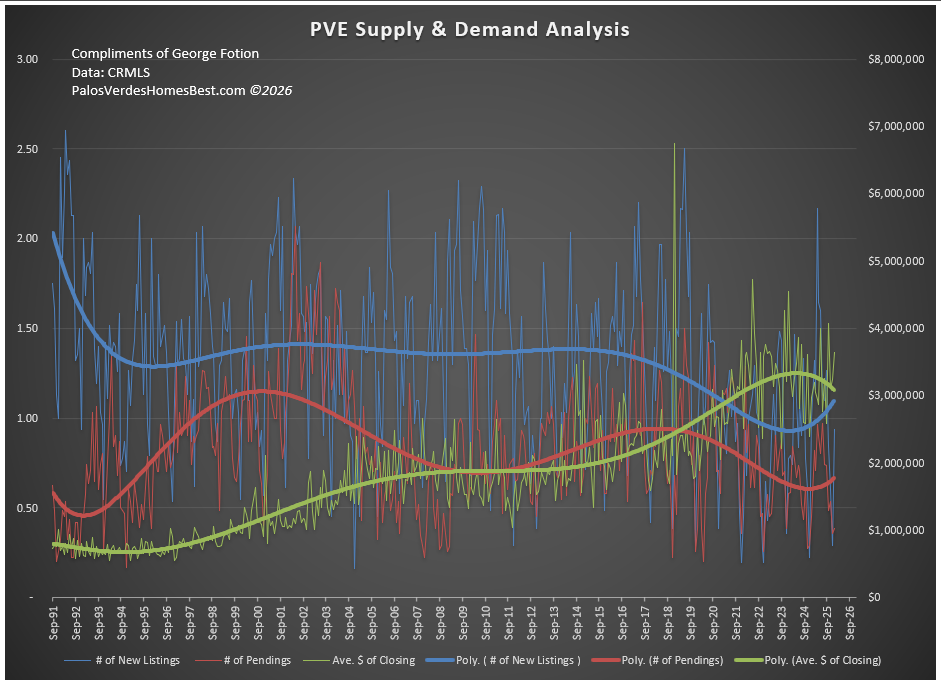

That question first leads us to ask what real estate really is. When we consider it, we know that it is simply a commodity. Just like any other commodity—gold, silver, live cattle futures—how is the price of any commodity determined?…

A commodity’s price is solely determined by the forces of SUPPLY AND DEMAND

From that, we come up with the next logical question. How do you measure supply and demand in the residential real estate market? Supply is the fairly easy part – it’s just the number of properties that were listed during any given period of time. Demand is a little trickier. I’ve found the best measure of demand is knowing the number of months of unsold inventory. In other words, the answer to this question … “Based on the rate at which homes are selling, how long will it take to sell existing levels of unsold inventory?” That’s demand. The lower the number for that metric, the higher the demand.

Now we have the basis to understand and verifiably, credibly and reliably what the facts are that will determine not only what the Palos Verdes homes market is doing now, but where prices might go in the future. Are you with me so far? At the very bottom of this article, there will be a short survey that will simply ask if you believe it is more likely that the price for Palos Verdes homes will go up 5% or more in the next 12 months, stay about the same, or go down 5% or more. Take a moment to click on your answer. If you need help understanding the content, methodology, and what the numbers in the table below mean, use my Calendly link (blue tab at the bottom of any page on this website) to schedule a time to jump on a Zoom call.

| Time Period | Palos Verdes Estates (Days to Sell Existing Supply) | Listing Volume | Pending Volume | %Change Listing Volume (Supply) Same Time Period Last Year | %Change Pending Volume (Demand) Same Time Period Last Year | Change in Unsold Inventory Index from Last Period | % Change in Unsold Inventory Index from Same Period Last Year |

| 9/1/2024-2/28/2025 | 325 | 103 | 57 | ||||

| 8/1/2025-1/31/2026 | 236 | 76 | 58 | ||||

| 9/1/2025-2/28/2026 | 259 | 79 | 55 | -23.30% | -3.51% | 9.62% | -20.51% |

| Time Period | Palos Verdes Peninsula (Days to Sell Existing Supply) | Listing Volume | Pending Volume | %Change Listing Volume (Supply) Same Time Period Last Year | %Change Pending Volume (Demand) Same Time Period Last Year | Change in Unsold Inventory Index from Last Period | % Change in Unsold Inventory Index from Same Period Last Year |

| 9/1/2024-2/28/2025 | 301 | 333 | 199 | ||||

| 8/1/2025-1/31/2026 | 198 | 262 | 238 | ||||

| 9/1/2025-2/28/2026 | 207 | 253 | 220 | -24.02% | 10.55% | 4.47% | -31.28% |

| Time Period | Greater South Bay Unsold Inventory (Days to Sell Existing Supply) | Listing Volume | Pending Volume | %Change Listing Volume (Supply) Same Time Period Last Year | %Change Pending Volume (Demand) Same Time Period Last Year | Change in Unsold Inventory Index from Last Period | % Change in Unsold Inventory Index from Same Period Last Year |

| 9/1/2024-2/28/2025 | 237 | 2932 | 2230 | ||||

| 8/1/2025-1/31/2026 | 225 | 2799 | 2238 | ||||

| 9/1/2025-2/28/2026 | 226 | 2757 | 2198 | -5.97% | -1.43% | 0.29% | -4.60% |

| Time Period | Rancho Palos Verdes Unsold Inventory (Days to Sell Existing Supply) | Listing Volume | Pending Volume | %Change Listing Volume (Supply) Same Time Period Last Year | %Change Pending Volume (Demand) Same Time Period Last Year | Change in Unsold Inventory Index from Last Period | % Change in Unsold Inventory Index from Same Period Last Year |

| 9/1/2024-2/28/2025 | 297 | 213 | 129 | ||||

| 8/1/2025-1/31/2026 | 191 | 158 | 149 | ||||

| 9/1/2025-2/28/2026 | 191 | 145 | 137 | -31.92% | 6.20% | -0.19% | -35.90% |

| Time Period | Rolling Hills Estates Unsold Inventory (Days to Sell Existing Supply) | Listing Volume | Pending Volume | %Change Listing Volume (Supply) Same Time Period Last Year | %Change Pending Volume (Demand) Same Time Period Last Year | Change in Unsold Inventory Index from Last Period | % Change in Unsold Inventory Index from Same Period Last Year |

| 9/1/2024-2/28/2025 | 186 | 29 | 28 | ||||

| 8/1/2025-1/31/2026 | 188 | 24 | 23 | ||||

| 9/1/2025-2/28/2026 | 214 | 25 | 21 | -13.79% | -25.00% | 14.09% | 14.94% |

| Time Period | Rolling Hills Unsold Inventory (Days to Sell Existing Supply) | Listing Volume | Pending Volume | %Change Listing Volume (Supply) Same Time Period Last Year | %Change Pending Volume (Demand) Same Time Period Last Year | Change in Unsold Inventory Index from Last Period | % Change in Unsold Inventory Index from Same Period Last Year |

| 9/1/2024-2/28/2025 | 576 | 16 | 5 | ||||

| 8/1/2025-1/31/2026 | 180 | 13 | 13 | ||||

| 9/1/2025-2/28/2026 | 164 | 10 | 11 | -37.50% | 120.00% | -9.09% | -71.59% |

Want to know more about the Department of Justice Settlement with the National Association of Realtors? You need to understand this because Buyers and Brokers must comply. Read more about it here

![Your Home Buyer Wants To Extend The Closing Date—What Now? [PART 2]](https://images.squarespace-cdn.com/content/v1/5c81e3acf8135a0b0481431d/1764096453674-LKL6GAPJQ6F4O64TSAXJ/banner.jpg?format=200w)